A DSCR loan, or Debt Service Coverage Ratio loan, is a unique type of real estate financing that evaluates the property’s ability to repay the loan rather than relying on the borrower’s personal income. This makes it an ideal option for real estate investors, entrepreneurs, and self-employed individuals who may not fit into the strict underwriting boxes of traditional lenders.

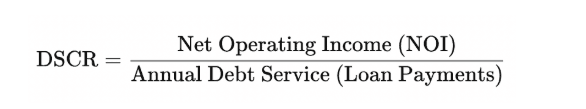

Instead of using tax returns, pay stubs, and W2s, DSCR lenders use a simple formula to qualify the borrower:

So if your rental property earns $10,000/month and your loan costs $7,500/month, your DSCR is 1.33. Most lenders in 2025 want to see a ratio of at least 1.20, which indicates the property is generating 20% more income than needed to cover its debt.

DSCR loans are especially valuable for:

This focus on cash flow rather than income makes DSCR loans a powerful tool, though often at the cost of slightly higher interest rates.

In contrast, traditional mortgage loans rely heavily on the borrower’s personal financial standing. These include:

To qualify, you’ll typically need:

Traditional loans generally offer lower interest rates than DSCR loans but come with more documentation, stricter guidelines, and longer approval timelines. They’re great for borrowers with stable W2 income, especially first-time homebuyers or owner-occupants.

For investors, however, traditional loans can be limiting. They’re hard to scale with, require personal guarantees, and often disqualify borrowers who take legitimate tax write-offs that lower their reportable income.

Let’s talk numbers.

As of 2025, DSCR loan interest rates typically range between 7.25% to 9.00%, depending on:

Why the higher rates? Because DSCR loans are non-QM loans (non-qualified mortgages). They fall outside the standard Fannie Mae/Freddie Mac guidelines, and since lenders take on more risk without verifying income, they price accordingly.

Additionally, investors benefit from more flexible underwriting and faster closings, making the trade-off worth it for many.

Traditional mortgage interest rates in 2025 for investment properties tend to range between 6.00% and 7.25%—significantly lower than DSCR loans. However, that rate is only available if you:

And those low rates? They often come with higher points, closing costs, or tougher appraisal hurdles.

In short, traditional rates are lower—but only if you can jump through the hoops.

Several factors drive the rate differences between DSCR and traditional loans. Here’s a breakdown:

| Factor | DSCR Loan Rates | Traditional Loan Rates |

| Documentation | Low (no income proof) | High (W2s, tax returns) |

| Risk Level | Higher (non-QM loan) | Lower (QM loan) |

| Property Type | More flexible | More restrictive |

| Investor Type | Ideal for self-employed | Ideal for W2 borrowers |

| Speed | Fast closings | Longer process |

So while DSCR loan interest rates are higher, they come with far fewer restrictions—making them the smarter option for investors who prioritize time, flexibility, and growth over marginal rate differences.

Despite being slightly higher, DSCR rates come with huge upsides:

In essence, you’re buying speed and simplicity. Many investors happily trade a slightly higher rate for the ability to close fast and keep scaling.

Of course, there are trade-offs:

That’s why it’s essential to analyze the full picture, not just the rate. A 7.75% DSCR loan on a strong cash-flowing deal might be better than a 6.50% traditional loan that takes 60 days and requires personal guarantees.

Here are scenarios where a higher DSCR rate makes sense:

In these cases, DSCR loans provide unmatched agility and efficiency, helping investors grow portfolios while avoiding traditional roadblocks.

When it comes to DSCR loan rates, one of the most significant pricing factors is the actual Debt Service Coverage Ratio of the property. In 2025, lenders are laser-focused on whether the rental income sufficiently covers the mortgage payment.

Here’s a quick reference:

The higher the DSCR, the lower the perceived risk to the lender. That’s why smart investors work on optimizing NOI (Net Operating Income) or negotiating a lower mortgage amount to bring the ratio up—shaving basis points off their DSCR loan interest rate in the process.

Some lenders even use tiered pricing. For example:

So, improving your DSCR isn’t just about qualifying, it’s about saving money long-term.

Beyond the DSCR ratio itself, several other factors influence DSCR lending rates:

Each of these elements can be leveraged to tailor your financing—and your returns.

Interest rates overall are influenced by macroeconomic factors like inflation, Fed policy, bond yields, and housing demand. In 2025, we’re seeing:

These trends mean DSCR lenders are keeping rates competitive while still building in a risk premium. It also means smart investors should act quickly, as DSCR loan rates can shift with the market.

Pro tip: Lock in rates early, especially if you’re getting close to closing. Even a 0.25% bump can cost thousands over the life of the loan.

DSCR loans are designed for a very specific investor profile. Here’s who should consider going this route:

In all these cases, the higher DSCR loan rate is often a worthwhile trade for the speed, flexibility, and documentation relief.

That said, there are still situations where traditional mortgages win:

If you can easily meet conventional loan criteria, and rate is your #1 concern, traditional loans will offer more favorable terms.

Ultimately, the choice between DSCR and traditional loans boils down to your strategy and timing.

Ask yourself:

If you answered yes to any of those, DSCR wins hands down. It’s a premium tool for professional investors and one that pays dividends far beyond the interest rate.

One of the easiest ways to reduce your interest rate is to boost your DSCR. Here’s how:

A stronger DSCR signals to lenders that your deal is low-risk, which they reward with better pricing.

Before you even apply, select investment properties with:

The better the property performs, the lower your DSCR rate. Cash-flowing properties are king in DSCR lending.

Not all lenders are created equal. If you’re comparing DSCR loan interest rates, work with a lender who:

At Cornerstone Mortgage Group, we tailor DSCR lending to your goals, offering competitive rates, lightning-fast closings, and strategic guidance every step of the way.

This is one of the most widespread misconceptions. Yes, DSCR loans typically have higher rates than traditional mortgages—but that doesn’t make them “bad.” In reality, they reflect the risk profile of non-QM lending and the flexibility borrowers enjoy.

Think about it: You’re getting approved based on the property alone—without income verification, W2s, or tax returns. That freedom comes at a small premium. But for real estate investors, the ability to scale faster, avoid DTI limits, and close in an LLC more than offsets the interest rate difference.

In 2025, competitive DSCR rates can be as low as 7.25% for strong deals, which is still well within profitable margins on solid cash-flowing rentals.

Totally false. DSCR loans are refinance-friendly—and many investors use them as short-term bridge solutions before refinancing into better long-term terms.

In fact, a common strategy looks like this:

You can also refinance from one DSCR loan to another—especially if your property’s performance has improved or interest rates drop. At Cornerstone Mortgage Group, we help investors track opportunities to refinance and save once their DSCR improves.

Another myth. While it’s true that many large-scale investors use DSCR loans, they’re also ideal for:

As long as the property’s numbers make sense, anyone can qualify. It’s not about how many units you own—it’s about how well your current (or target) property performs.

In the battle of DSCR loan rates vs traditional loan rates, there’s no one-size-fits-all answer. It’s all about what you value most: rock-bottom rates or maximum flexibility.

If you’re an investor who values:

...then a slightly higher DSCR loan interest rate is a small price to pay for a massive boost in freedom and growth potential.

But if you’re:

...then traditional loans may be a better fit—at least for now.

Whatever your goals, Cornerstone Mortgage Group can help you find the right product, secure the best terms, and scale your portfolio with confidence.

Yes, generally by 1–2%, due to the flexibility and no-income-verification nature of DSCR loans. However, the tradeoff is faster approvals and easier qualification for real estate investors.

Absolutely. Many investors start with a DSCR loan, then refinance into a traditional mortgage after improving the property or stabilizing income.

Both. DSCR lenders offer 30-year fixed, interest-only, and ARM options. Your rate will depend on the structure you choose and your deal’s strength.

A competitive rate in today’s market falls between 7.25% and 8.25%. Lower rates are available for high DSCR ratios and excellent credit.

Borrowers with stable W2 income buying a primary residence, or investors who don’t mind extensive paperwork and want the absolute lowest rate possible, may prefer traditional financing.