A Debt Service Coverage Ratio loan, more commonly known as a DSCR loan, isn’t your typical mortgage. In fact, it’s a game-changer for real estate investors, landlords, and entrepreneurs who want to build wealth through income-producing properties without the headache of documenting personal income. But what exactly is it?

A DSCR loan is a type of real estate mortgage that focuses on the income generated by the property itself, not your W2s, tax returns, or traditional financial documentation. This means that your qualification hinges on how well your property performs financially, not how much you personally earn.

This is where the "Debt Service Coverage Ratio" comes in. The DSCR is a key metric lenders use to determine whether the rental income from the property is sufficient to cover the mortgage payments (also known as debt service). The higher your DSCR, the better your chances of getting approved, and often, at better terms.

Whether you're flipping Airbnbs, holding long-term rentals, or diving into commercial deals, DSCR loans in 2025 offer more flexibility than ever. With real estate markets shifting and lending rules tightening for traditional mortgages, DSCR loans are standing out as a vital financing tool for anyone serious about real estate investing.

In today’s fast-paced, entrepreneurial environment, more people are investing in real estate full-time or as a side hustle. The catch? Traditional banks often don’t understand this business model. They want W2 income, two years of tax returns, and detailed personal financial histories. That’s where DSCR loans come in.

In 2025, DSCR loans have surged in popularity because they:

The best part? Lenders don’t care if your personal income is seasonal, inconsistent, or tied up in your business. As long as the property cash flows well and meets the required DSCR, you’re in the game.

This makes debt service coverage ratio loans the go-to choice for:

In a world where traditional mortgage approvals are becoming tougher, DSCR loans in 2025 are making financing more accessible than ever, especially through trusted lenders like Cornerstone Mortgage Group.

Let’s start with the basics: DSCR stands for Debt Service Coverage Ratio. In financial speak, it measures a property’s ability to generate enough income to cover its debt obligations. In plain terms, it answers a simple question: Does the rental income from this property cover the mortgage payment—and then some?

Here’s how it breaks down:

Where:

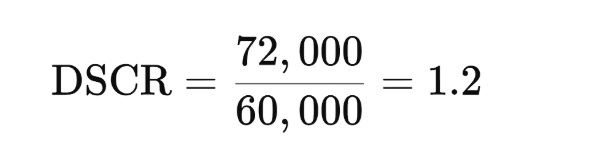

If your DSCR is 1.0, your income exactly covers your debt. If it’s 1.25, you earn 25% more than you need to cover your loan. Most lenders in 2025 want to see a DSCR of at least 1.2, though some may go as low as 1.0 for strong borrowers or properties in booming rental markets.

Why do lenders care so much about the DSCR? Because it tells them whether the deal makes sense financially—independent of your personal finances. This makes it one of the most objective, risk-based tools for underwriting investment properties.

Think of DSCR as your property’s financial report card. If the property passes, meaning it brings in more income than it needs to cover its mortgage then it qualifies. If not, you may need to rethink the deal or improve the numbers.

Here’s what the DSCR helps lenders determine:

In 2025, DSCR-based underwriting has become especially important as more investors use creative financing, short-term rentals, and cash-out strategies. The DSCR ensures that each deal stands on its own, no personal guarantees required.

To qualify for a DSCR loan, you need to understand and apply the DSCR formula.

Let’s say:

Now plug in the numbers:

A DSCR of 1.2 means your property generates 20% more income than needed to cover the mortgage—exactly what most lenders want to see.

The ideal DSCR ratio can vary slightly depending on the lender, but here’s the general rule of thumb for 2025:

| DSCR Ratio | Meaning | Lender View | |

| Below 1.0 | Property income doesn’t cover debt | Likely denied | |

| 1.0 – 1.15 | Break-even or slim margin | May be considered with conditions | |

| 1.2 – 1.35 | Healthy coverage | Preferred by most lenders |

Lenders like Cornerstone Mortgage Group often target that 1.2 ratio as the baseline, though exceptions can be made based on credit, reserves, and property location.

A higher DSCR gives you more negotiating power, access to better interest rates, and smoother approval. It also makes your portfolio more resilient in the long term.

For lenders, DSCR is more than just a number, it’s a risk management tool.

In a DSCR loan, the lender isn’t asking: “How much money do you make?” They’re asking: “Can this property pay for itself?” It shifts the focus entirely to the asset, which aligns perfectly with the goals of real estate investors.

Lenders assess:

By focusing on the debt coverage ratio, lenders protect themselves and ensure the borrower isn’t getting over-leveraged. At the same time, investors can move faster, scale their portfolios, and qualify based on performance—not paperwork.

In 2025, lenders are maintaining a conservative yet flexible stance on DSCR loan qualifications. One of the primary qualifiers remains the minimum DSCR ratio, which tells the lender whether your rental property is bringing in enough income to pay for its mortgage with a margin of safety.

The general standard across most lenders is a minimum DSCR of 1.20. This means your property needs to earn 20% more income than what is required to cover the annual debt service (principal + interest payments). Here's a breakdown:

In 2025, some more aggressive lenders may go as low as 0.95 DSCR for certain high-yield properties or returning clients, especially through niche products offered by specialized institutions like Cornerstone Mortgage Group. However, keep in mind that the lower your DSCR, the more other factors—like credit score or reserves—must compensate to mitigate risk.

One of the biggest draws of DSCR loans is the light documentation requirement—especially compared to traditional mortgages. However, "light" doesn’t mean “none.” Here’s what you’ll typically need to provide to get approved for a debt coverage ratio loan in 2025:

Required Docs:

What’s not typically required:

That’s what makes DSCR loans so appealing—especially for self-employed borrowers, business owners, and freelancers.

While DSCR loans are flexible in many ways, lenders still want borrowers to have some “skin in the game.” That means LTV (Loan-to-Value) limits and down payment requirements apply. Here’s what to expect in 2025:

For instance, if you're buying a $400,000 rental property, you’d typically need to put down at least $80,000 (20%), and the loan would cover the remaining $320,000.

That being said, lenders like Cornerstone Mortgage Group may offer better terms or higher LTVs for borrowers with strong credit and DSCR ratios.

In addition, some lenders will also require:

Having strong cash flow and liquidity helps not only in meeting DSCR requirements but also in covering these upfront costs without stretching your budget too thin.

One of the beauties of DSCR loans is the flexibility in property types. In 2025, most DSCR lenders are comfortable financing a wide range of residential and commercial investment properties as long as they produce income.

Commonly eligible property types include:

What's generally not eligible?

Each lender has slightly different guidelines, but Cornerstone Mortgage Group and other investor-focused lenders often offer tailored DSCR loans for short-term rentals and unique properties, especially if they show a strong rental history or seasonal income average.

Because the DSCR is all about cash flow, lenders will evaluate the property’s actual or projected income versus its operating expenses and mortgage payments.

In 2025, cash flow is calculated based on:

Lenders don’t just take the gross rent at face value. They deduct realistic costs, including:

Then, they determine if what’s left (the NOI) is enough to service the mortgage debt. The more positive cash flow your property has, the higher your DSCR—and the easier your path to loan approval.

Pro tip: Make sure your listing, rent rolls, and expense records are accurate and up-to-date. Misreporting or underestimating costs is one of the fastest ways to get denied.

Whether you're financing a traditional long-term rental or a trendy short-term stay, having solid lease agreements or rental income documentation is a must.

For long-term rentals, you’ll usually need:

For short-term rentals, lenders may ask for:

Some lenders even allow projected income based on a market rent analysis if the property is new or vacant, though this might come with lower LTVs or higher DSCR thresholds.

Even though DSCR loans prioritize property performance over personal income, credit score still matters—especially in 2025. Your credit score helps lenders determine how trustworthy and financially stable you are outside the property’s performance.

Here’s the typical breakdown:

A higher score generally means:

At Cornerstone Mortgage Group, for example, borrowers with a DSCR above 1.2 and a credit score of 700+ are typically eligible for the most competitive terms in the market.

That said, DSCR loans are still more flexible than conventional loans when it comes to credit. If you’ve had a few dings—like a late payment or an older bankruptcy—you’re not automatically disqualified. As long as the property’s numbers work, many DSCR lenders will still approve your loan.

One area DSCR loans do take seriously is liquidity. Lenders want to see that you have enough cash or liquid assets on hand to keep things running in case your property hits a rough patch—like a vacancy or unexpected repair.

Typical reserve requirements in 2025:

These reserves don’t get touched unless needed—but they give lenders peace of mind. In competitive real estate markets or for borrowers with lower DSCR ratios, having strong reserves can be the deciding factor between an approval and a denial.

Pro tip: Build up a reserve fund not just for qualification, but to protect your investment long-term.

In 2025, more investors are buying real estate through LLCs or corporations to limit liability and optimize taxes. The good news? DSCR loans support that.

Most DSCR lenders will fund:

Some even require it. This is great for protecting your personal assets and keeping investment operations separate from your personal finances.

At Cornerstone Mortgage Group, we support loans to both individuals and business entities, and we guide investors on how to properly structure ownership for compliance and long-term scalability.

If you’re using a business entity, just make sure:

DSCR loans fall under the category of non-QM loans, which stands for “non-qualified mortgages.” These are loans that don’t meet Fannie Mae or Freddie Mac’s strict guidelines—but they still offer secure, competitive financing.

Non-QM DSCR loans in 2025 are more widely available than ever, and typically include:

These options give you incredible flexibility, especially if you’re building a diverse or fast-growing investment portfolio.

Cornerstone Mortgage Group offers a robust selection of non-QM DSCR products customized to fit your strategy, whether you’re refinancing, purchasing, or expanding a short-term rental empire.

Interest rates for DSCR loans are generally 1–2% higher than traditional mortgage rates, given the added risk of no income verification. But in 2025, rates have remained competitive due to high demand and expanding lender offerings.

Typical terms include:

Rates vary based on:

One trend to watch in 2025: customized terms for short-term rentals and unique property types. More lenders are now offering niche pricing and more lenient requirements for high-income-producing assets like Airbnbs, especially in hot markets.

Let’s compare a DSCR mortgage to a traditional investment property loan so you can see why so many investors are making the switch.

| Feature | DSCR Loan | Traditional Loan |

| Income Documentation | Not required | Full income verification |

| Approval Speed | Fast | Slower |

| Property-Based Qualification | Yes | No |

| Max Properties Allowed | Flexible | Often limited |

| Ideal For | Investors, self-employed | Salaried individuals |

| Down Payment | 20–30% | As low as 15–20% |

DSCR loans offer simplicity and scalability, especially for experienced investors and those with complex tax returns. Traditional loans might offer lower rates, but they come with more hoops, more paperwork, and often stricter limitations.

If you're eyeing a DSCR loan, the most effective way to qualify—and get better rates—is to increase your property’s NOI. Since the DSCR formula relies heavily on NOI, improving it can directly raise your DSCR ratio and reduce risk in the eyes of the lender.

Here are actionable strategies for boosting NOI:

By improving your property’s income-to-expense ratio, you not only meet DSCR minimums—you surpass them, putting yourself in a stronger negotiating position with lenders like Cornerstone Mortgage Group.

On the flip side of boosting income is cutting down debt service. If your mortgage payment is too high relative to your NOI, your DSCR ratio will suffer, even if your rent is solid.

Here’s how to reduce debt obligations and improve DSCR:

These strategies reduce your required monthly payments, which lifts your DSCR ratio without touching your rental income.

In 2025, smart investors understand that location and positioning are just as crucial as NOI and debt service.

Here’s how to optimize your DSCR through market strategy:

Positioning your property strategically in the market not only improves income, it also reassures lenders that you’ve done your homework, increasing their confidence in approving your DSCR mortgage.

This is one of the most common and costly mistakes investors make when applying for a debt service coverage ratio loan. Just because your property could rent for a certain amount doesn’t mean that number will be accepted by the lender.

Here’s what to avoid:

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lenders rely on market rent analysis or actual leases, not wishful thinking. Always back up your income claims with solid documentation.

While income gets most of the attention, expenses are just as important in calculating NOI and DSCR. If you fail to disclose key expenses, your DSCR may look artificially high—and lenders will catch it.

Make sure to include:

Underestimating expenses can cause a deal to fall apart late in the underwriting process. Transparency is key.

Every DSCR lender is different. Some accept short-term rentals; others don’t. Some want a DSCR of 1.2; others will take 1.0. Some allow LLC ownership; others require personal guarantees.

Failing to align with your lender’s criteria can lead to:

Work with a lender like Cornerstone Mortgage Group who understands investor needs and will walk you through the exact requirements before you apply.

DSCR loans aren’t your run-of-the-mill mortgage product. They require nuanced underwriting, experience in investment finance, and speed. That’s why working with a DSCR loan specialist is crucial.

At Cornerstone Mortgage Group, we:

Instead of just selling you a loan, we help you strategize your portfolio and scale smarter.

Before you lock in a DSCR mortgage, ask your lender:

The right lender won’t just answer your questions, they’ll guide you toward the best product for your strategy.

Prequalification is fast and easy with the right lender. At Cornerstone Mortgage Group, you can:

The process is smooth, straightforward, and tailored for property-focused financing.

DSCR loans have revolutionized real estate financing for investors in 2025. With minimal documentation, fast approvals, and asset-based underwriting, they’ve made it easier than ever to scale your portfolio, especially if you’re self-employed, own multiple properties, or run short-term rentals.

But like any loan, success comes down to preparation. Know your numbers. Understand your DSCR. Work with a lender that specializes in investor-friendly programs.

At Cornerstone Mortgage Group, we’re here to help you navigate the process, secure competitive terms, and grow your investment business with confidence.

Ready to get prequalified? Let’s talk.

Yes. DSCR loans do not require traditional income documentation. Lenders qualify you based on the property’s income and debt coverage ratio.

Single-family rentals and multifamily properties with solid rental histories are easiest to finance. Short-term rentals also qualify with the right documentation.

Yes, many lenders—including Cornerstone Mortgage Group—offer DSCR loans specifically for Airbnb and vacation rentals, using average monthly income for DSCR calculation.

Absolutely. As long as the property qualifies and you meet credit and reserve requirements, you can use a DSCR loan for your first investment purchase.

With Cornerstone Mortgage Group, pre-approval typically takes 1–2 days, and most DSCR loans close within 2–4 weeks, depending on documentation and appraisal timelines.